Rapid Response - CPI keeps the RBA on track to cut rates next week

- Brett Careedy

- Jul 30, 2025

- 3 min read

Australian inflation was slightly slower than in the March quarter, likely keeping the RBA on track to ease next month. But household budgets are still being squeezed.

Australian headline consumer price inflation slowed by more than anticipated in the June quarter.

Quarterly CPI increased by +0.7%, down from +0.9% in Q1 and below the +0.8% consensus estimate.

Annual headline inflation slowed from +2.4% in Q1 to +2.1% in Q2, also slightly below the +2.2% estimate.

Trimmed mean (core) quarterly inflation also slowed by more than anticipated to +0.6%. Economists had expected it to hit +0.7% for the second quarter in a row.

The critical annual trimmed mean measure from a policy perspective slowed from +2.9% to +2.7%, as anticipated.

Weighted median core inflation slowed from +2.9% yoy (revised down from +3.0% yoy) to +2.7% yoy, as expected.

The primary contributor to the slowing of annual inflation was a significant fall in Automotive fuel prices (-10.0%). Annual price rises for New Dwellings (+0.7%), Rents (+4.5%) and Insurance (+3.9%) continued to slow.

Food and non-alcoholic beverages annual inflation was +3.0 per cent to the June quarter. Food inflation stayed elevated due to higher prices for Fruit and vegetables, up +4.6% yoy.

The quarterly growth in Housing was driven by Electricity (+8.1%). The second instalments of both the Commonwealth Energy Bill Relief Fund and State government rebates in Perth were used up by households in the previous quarter. Rebates have the effect of reducing electricity costs for households. This has meant higher out-of-pocket electricity costs this quarter as rebates have been used up. However, electricity bills are still down -6.2% compared to a year ago.

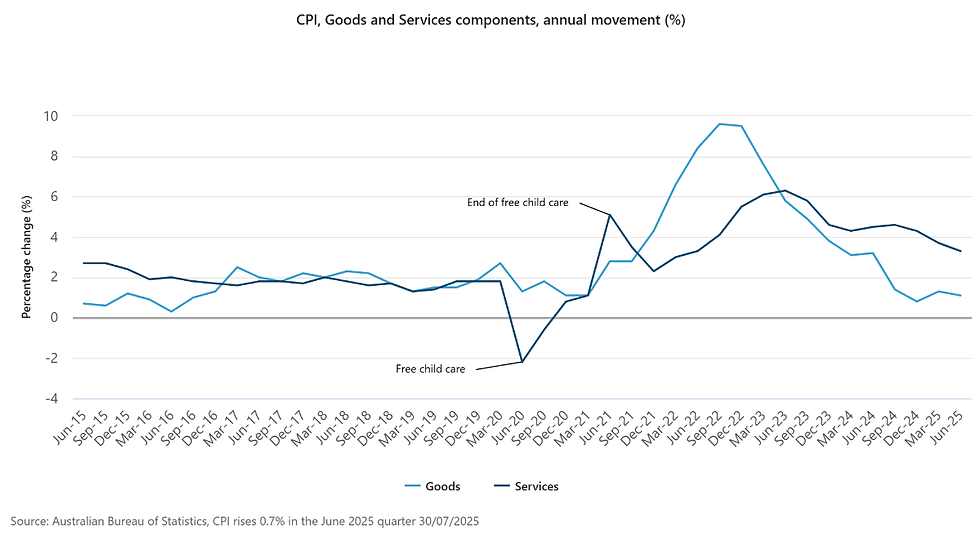

Annual Goods inflation was +1.1%, down from +1.3% in Q1.

Annual Services inflation was +3.3% to the June quarter, down from 3.7%.

The ABS also confirmed that the quarterly series will transfer to an improved, full monthly estimate from November 2025. Until now, the monthly estimate was based on a sample and largely discounted by the RBA in setting policy.

Fin-X Wealth View

The continued progress on inflation provides the RBA with room to cut rates again, likely as soon as the August meeting next week.

Market pricing suggests that the Board will likely still favour gradual easing, with no change to the expected low of around 3% in mid-2026.

However, the details of the CPI show that household budgets are still under pressure from the costs of essentials outpacing discretionary items and services. As a consequence, there are probably some downside risks to consumer spending, and therefore to the expected path of rates.

Interestingly, the slowing of goods price inflation supports the view that American tariffs are not inflationary, as the RBA has already concluded. However, if the resulting slowing of global growth manifests as lower employment in Australia, the disinflationary consequences could become more apparent.

The skew of risks to the downside makes bonds marginally more attractive.

Disclaimer

The contents of this communication is prepared by Brerona Capital Asset Management Pty Ltd (A.C.N. 627 650 293; AFSL 520526). The information contained in this communication is general in nature and does not take into consideration any investors personal objectives, goals, needs and financial situation. You should not rely on the information contained in this document to make any investment decisions without first consulting an investment professional such as your financial adviser. Any unauthorised use of this document is prohibited. This document (including any attachments) is intended only for the addressee, it may contain information of a privileged and confidential nature. If you are not the addressee of this communication, you must not copy, reproduce, disseminate or use this email and its contents. If this communication has been received in error by you, please inform us immediately and securely delete. Sharing, transmitting, copying, disseminating all or part of the contents of this document may result in a breach of the Federal Privacy Legislation and or copyright and trademark infringement of Brerona Capital Asset Management Pty Ltd and its related entities.