FinX Weekly 16 June 2025

- Brett Careedy

- Jun 16, 2025

- 4 min read

US-China trade talks yielded a framework deal, avoiding a return to peak tariffs. China’s trade surplus has increased despite recent tensions.

US inflation readings rose by less than feared, and consumer sentiment and small business confidence improved. Australian surveys were mixed.

This week, attention turns to global central bank decisions. The Fed’s updated projections and Australian jobs figures will be closely watched, while the Prime Minister is scheduled to meet the American president on the sidelines of the G7 meeting due to take place in Canada.

The timing and coordination of Israel’s attack raised questions internationally, particularly around the extent of US involvement. Secretary of State Marco Rubio initially denied advance knowledge, a claim later contradicted by President Trump. The escalation comes after repeated warnings by Prime Minister Netanyahu regarding Iran’s nuclear ambitions and is the first major foreign-policy test of Trump’s second term.

Markets responded with a shift to safe havens. Brent crude surged by nearly +12% over the week, while gold price gains were just shy of +4%.

Equity indices dipped, though losses were less severe than might have been expected, helped by relatively ample liquidity conditions. The US Treasury has been drawing down its General Account and moderating bond issuance while the president’s flagship “Big Beautiful Bill” remains under scrutiny in the Senate.

Risk sentiment was also buoyed by an apparent breakthrough in US - China trade talks in London. The two countries reached a framework agreement that appears to prevent tariffs from returning to the peak levels seen in April. China committed to a limited resumption of rare earth exports to the US, but the broader trade relationship remains strained. Structural issues, including China’s growing trade surplus and allegations of dumping, remain unresolved. Data released Monday showed China’s surplus widening further as imports contracted faster than exports.

Under the terms of the deal, tariffs on Chinese goods will remain at 30%, or 55% when including prior measures. China will add 10% tariffs on US imports in response. The framework awaits final sign-off by both presidents.

Bond yields drifted lower for most of the week, supported by US inflation data that came in slightly softer than feared. Headline CPI rose to +2.4% yoy in May from +2.3% in April, held down by a -3.5% yoy drop in energy prices.

Core CPI remained steady at +2.8% yoy, just below expectations, while the “supercore” measure of services excluding shelter rose marginally and is now up +2.9% yoy, well below its +4.0% pace earlier in the year. PPI also firmed modestly, but did little to alter expectations for the Fed’s preferred PCE measure, due later this month.

Nonetheless, inflation remains above target and is moving in the wrong direction. Market pricing still reflects two rate cuts this year, though the Fed is expected to project fewer cuts in this week’s updated “dot plots”.

Consumer inflation expectations remain elevated: the New York Fed survey showed one-year inflation at +3.2%, while the University of Michigan survey placed the one-year outlook at +5.1% and five-year expectations at +4.1%. Even so, as these expectations have moderated somewhat in recent weeks, consumer sentiment improved, with the Michigan index rising to 60.5 in June, up nearly +16% from the prior month. Small business confidence also picked up to close to the long-term average level, according to the NFIB.

In Australia, economic indicators were mixed. The NAB business conditions index continued to ease in May, but Westpac’s consumer sentiment index rose in June. The S&P/ASX 300 reached a record high of 8,520 on Wednesday before declining alongside global markets after the Middle East escalation. The domestic labour market remains resilient, with this week’s jobs data expected to show the unemployment rate steady at 4.1%.

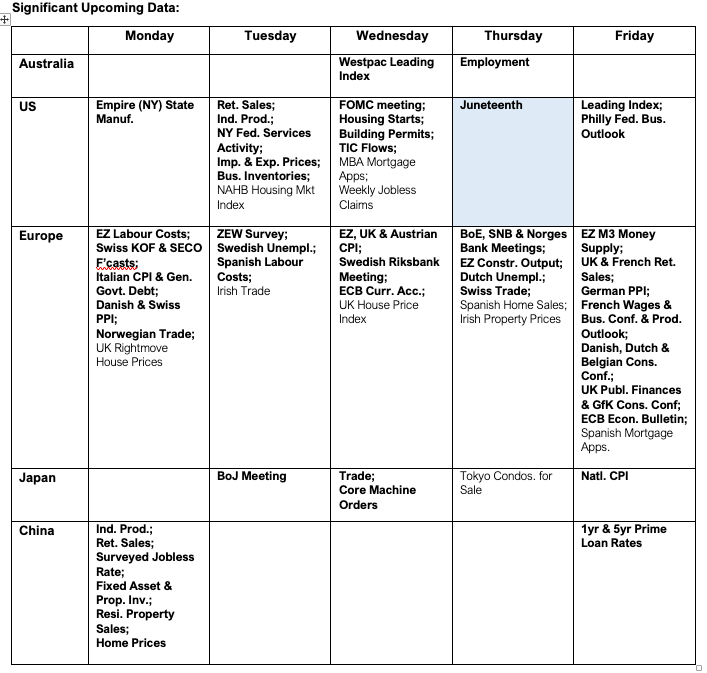

Looking ahead, several major central banks will hold policy meetings this week. The Federal Reserve, along with the central banks of Japan, China, the UK and Norway, are expected to leave policy settings unchanged, while rate cuts are likely in Switzerland and Sweden. Key economic releases include retail sales and industrial production figures from the US and China, along with Chinese monthly activity data. The US market will be closed on Thursday for the Juneteenth holiday

Disclaimer

The contents of this communication is prepared by Brerona Capital Asset Management Pty Ltd (A.C.N. 627 650 293; AFSL 520526). The information contained in this communication is general in nature and does not take into consideration any investors personal objectives, goals, needs and financial situation. You should not rely on the information contained in this document to make any investment decisions without first consulting an investment professional such as your financial adviser. Any unauthorised use of this document is prohibited. This document (including any attachments) is intended only for the addressee, it may contain information of a privileged and confidential nature. If you are not the addressee of this communication, you must not copy, reproduce, disseminate or use this email and its contents. If this communication has been received in error by you, please inform us immediately and securely delete. Sharing, transmitting, copying, disseminating all or part of the contents of this document may result in a breach of the Federal Privacy Legislation and or copyright and trademark infringement of Brerona Capital Asset Management Pty Ltd and its related entities.