Fin-X Weekly 20th of October 2025

- Brett Careedy

- Oct 20, 2025

- 5 min read

Global equities recovered as easing trade tensions and resilient US bank earnings offset growing credit concerns. But safe-haven demand also persisted, with gold advancing to new highs and bond yields holding near recent lows.

The American administration’s tone towards Beijing softened, though policy uncertainty remains high. The Federal Reserve signalled its quantitative tightening cycle is nearing completion.

In Australia, the Treasurer scaled back proposed tax changes while the Reserve Bank reiterated that policy remains marginally tight ahead of a rise in headline unemployment.

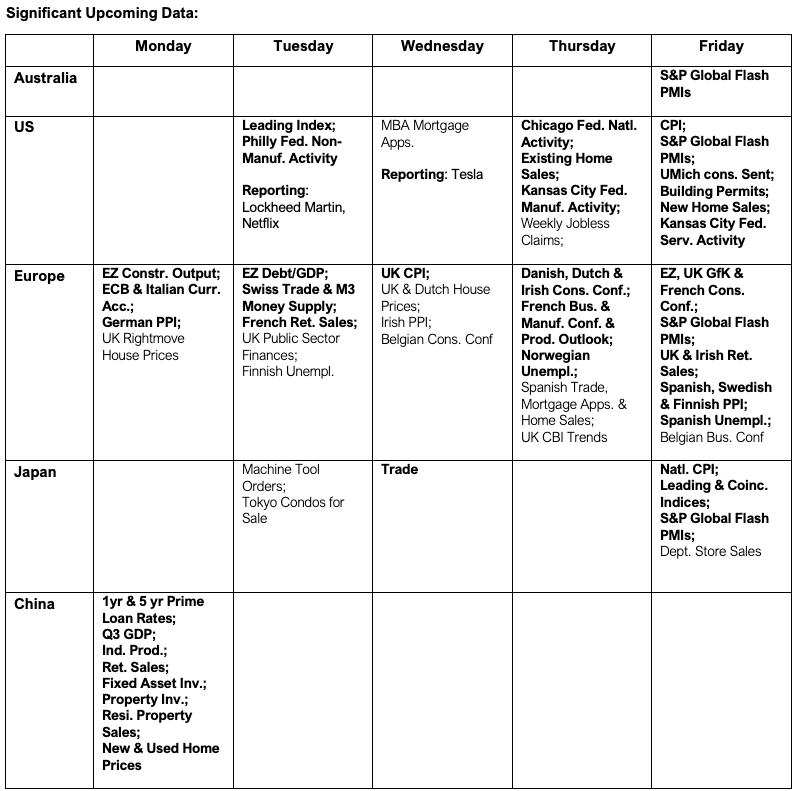

Attention will now turn to upcoming Chinese growth data, inflation readings, and the global flash PMI surveys. Earnings season continues with 88 S&P500 companies scheduled to report.

Global stocks recovered last week after the previous week’s tariff scare. The administration softened its hawkish comments towards China, while strong US bank earnings helped indices to shrug off growing credit concerns. At the same time, gold extended its rally to new highs on expectations of monetary easing and geopolitical tensions, while bond yields remained near recent lows as limited data continued amid the ongoing US government shutdown.

US equity-index futures rose on Monday after President Donald Trump signalled a willingness to strike a deal with China, lifting sentiment following a sharp escalation in trade tensions. On Sunday, he moderated his rhetoric, posting on Truth Social: “Don’t worry about China, it will all be fine.”

US Trade Representative Jamieson Greer told CNBC on Tuesday that China’s next steps would determine whether the 100% additional tariffs threatened by Trump would take effect on 1st November. Later that day, Trump renewed his criticism of China on Truth Social, saying the country was refusing to buy US soybeans in “an economically hostile act”. He also warned of possible “retribution”, including a cooking oil embargo. The president also declared that the US was “now” in a trade war with China. Treasury Secretary Scott Bessent subsequently proposed a longer truce if Beijing delayed plans to tighten its control of critical rare earth supplies. G7 finance chiefs are set to discuss a joint response to potential Chinese export curbs.

China’s September trade data surprised on the upside, with exports up +8.3% year on year and imports rising +7.4%. The figures suggested Beijing could afford to be patient, although economists will be watching for more sustained strength beyond the period leading up to the national holidays. CPI and PPI figures confirmed continued deflationary pressure, while GDP data, due later today, is expected to show a slowing from +5.2% yoy in the second quarter to +4.7% yoy.

The Federal Reserve’s Stephen Miran said that US-China uncertainty had created a “new tail risk” and that two more rate cuts this year “sound realistic”. Both are already fully priced in, although delayed CPI figures due on Friday are expected to show inflation moving further above the Fed’s target.

At the NABE conference, Jerome Powell reaffirmed the Federal Reserve’s economic outlook and announced that the Fed is nearing the end of its quantitative tightening (“QT”) programme. The timing is significant as liquidity stress may be building in repo and credit markets.

Goldman Sachs, Morgan Stanley, Bank of America, and JP Morgan all exceeded expectations on stronger investment banking and trading revenues. However, US equities later declined after two regional banks disclosed problem loans. Fraud-linked write-downs at Zions Bancorp and Western Alliance followed the recent failures of First Brands Group and Tricolor Holdings, which were triggered by tariffs and changes to immigration policy, respectively. These developments exposed vulnerabilities in the private and bank credit markets. On the JP Morgan earnings call, Chairman and CEO Jamie Dimon cautioned that recent credit shocks could signal broader issues, saying, “I probably shouldn’t say this, but when you see one cockroach, there are probably more. Everyone should be forewarned on this one.”

The IMF upgraded its forecasts compared to those issued shortly after the April 2nd tariff announcements, saying, “The global economy is adjusting to a landscape reshaped by new policy measures. Some extremes of higher tariffs were tempered, thanks to subsequent deals and resets. But the overall environment remains volatile, and temporary factors that supported activity in the first half of 2025—such as front-loading—are fading. As a result, global growth projections in the latest World Economic Outlook (WEO) are revised upward relative to the April 2025 WEO but continue to mark a downward revision relative to the pre-policy-shift forecasts.”

In Australia, markets welcomed the Treasurer’s decision to scale back the government’s proposed $3 million superannuation tax following intense criticism from tax experts and investors.

The Reserve Bank of Australia was also active, with senior officials making several appearances at conferences in Washington and Sydney. On the sidelines of IMF meetings, Governor Michelle Bullock adopted a mildly hawkish tone, noting that monetary policy remained “marginally tight”. Assistant Governor Chris Kent said in Sydney that financial conditions were gradually easing. At the same time, Assistant Governor Sara Hunter remarked that “high frequency data suggests that underlying inflation in the September quarter is likely to be stronger than we anticipated. This may suggest that the labour market, and economic conditions more generally, remain a bit tighter than we had assessed – and we’re actively analysing this question ahead of our next set of forecasts, which will be released in November. At the same time, employment growth has slowed slightly more than we expected, and uncertainty about the global outlook remains elevated.”

Released on Thursday, Australia’s September unemployment rate rose unexpectedly to 4.5%, reflecting higher participation rather than job losses. Earlier in the week, the NAB monthly business survey indicated improving confidence. Nevertheless, there were signs in the data that labour demand may be peaking, and the market has moved to once again price two full rate cuts by the end of 2026.

Significant Chinese data releases are due later today, with prime lending rates expected to remain unchanged.

Delayed US inflation data are scheduled for Friday, following CPI updates in the UK and Japan. Also on Friday, the latest round of flash PMI surveys will provide further insight into global growth momentum.

Netflix and Tesla are among the 88 S&P 500 companies scheduled to report this week.

See also S&P 500 Earnings Season Update for more information.

Disclaimer

The contents of this communication is prepared by Brerona Capital Asset Management Pty Ltd (A.C.N. 627 650 293;

AFSL 520526). The information contained in this communication is general in nature and does not take into consideration any investors personal objectives, goals, needs and financial situation. You should not rely on the information contained in this document to make any investment decisions without first consulting an investment professional such as your financial adviser. Any unauthorised use of this document is prohibited. This document (including any attachments) is intended only for the addressee, it may contain information of a privileged and confidential nature. If you are not the addressee of this communication, you must not copy, reproduce, disseminate or use this email and its contents. If this communication has been received in error by you, please inform us immediately and securely delete. Sharing, transmitting, copying, disseminating all or part of the contents of this document may result in a breach of the Federal Privacy Legislation and or copyright and trademark infringement of Brerona Capital Asset Management Pty Ltd and its related entities.